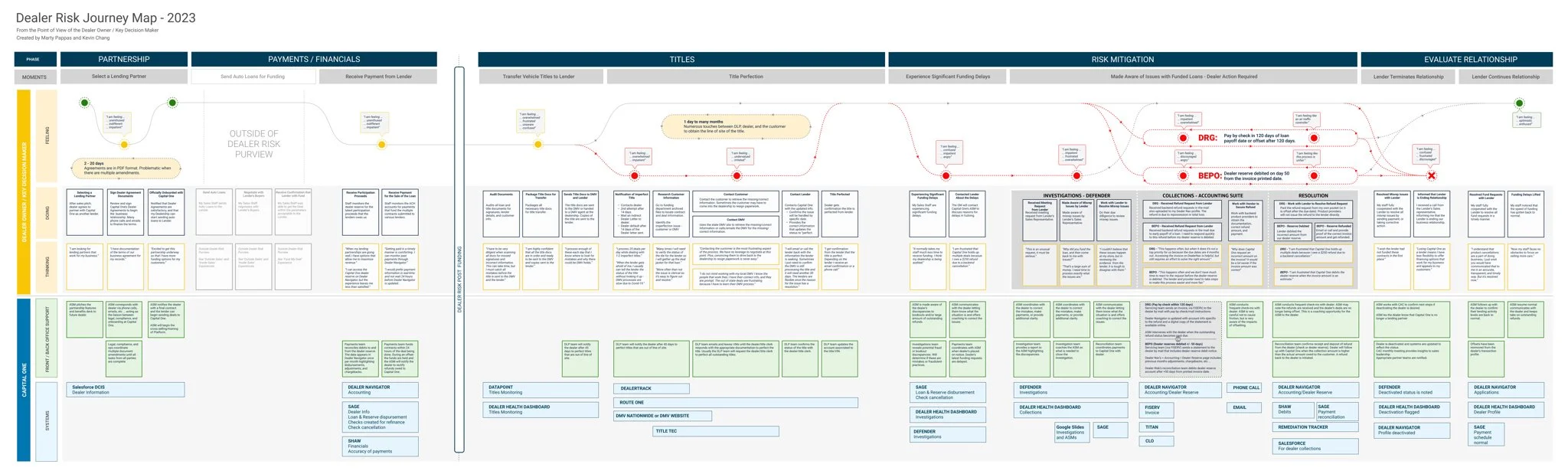

Transforming Auto Finance Through Human-Centered Design at Capital One

Overview

Capital One, the nation's largest auto lender, serves over 4.5 million customers and collaborates with 17,000 dealerships.Recognizing the complexities in dealer-lender interactions, Capital One embarked on a digital transformation to streamline processes, enhance transparency, and empower dealerships with better tools and data.

The Challenge

Dealerships often grappled with:

Limited visibility into financial interactions with lenders.

Inefficient processes leading to missed obligations and friction.

Challenges in managing payments and understanding the nuances of each lending relationship.

These issues highlighted the need for a comprehensive solution that addressed both technological and human factors.

The Approach

Under the leadership of Marty Pappas, Capital One adopted a human-centered design methodology:

Empathy & Research: Conducted over 70 sessions with customers and associates to gather insights.

Iterative Design: Integrated continuous feedback into agile development cycles.

Collaborative Prototyping: Engaged co-creators to test and refine solutions.

Service Design: Mapped user journeys to identify pain points and opportunities.

The Solution

The team developed a suite of tools and platforms, including:

Self-Service Dealer Dashboard: Provided real-time access to accounts receivable/payable, refunds, and title perfection statuses.

Digital Communication Strategies: Enhanced dealer engagement and platform adoption.

Innovative Loan Servicing Products: Streamlined processes, reducing manual interventions and errors.

The Results

Digitized the auto lien process, setting a new industry standard.

Achieved over 20% increase in B2B platform adoption among dealers.

Transformed loan servicing, positively impacting over 4.5 million customers.